What is pump and dump fraud in the cryptocurrency market and how is it implemented?

Want to know about pump and dump fraud in cryptocurrency? Learn the tactics used and stay alert to protect your assets. Act now for safety!

Understanding Pump and Dump Fraud in the Cryptocurrency Market

Cryptocurrency is a fascinating digital world full of opportunities and challenges. One of the darker sides of this world is a scam known as "pump and dump." In this article, we will break down what pump and dump fraud is, how it works, and how you can protect yourself from falling victim to it.

What is Pump and Dump Fraud?

Pump and dump is an illegal practice in financial markets, not just in cryptocurrency. Recently, with the growth of online platforms and the rise of cryptocurrencies, this scheme has become more common among scammers.

The absence of clear regulations and laws related to cryptocurrency has made it easier for fraudsters to target people with digital currency pump and dump scams.

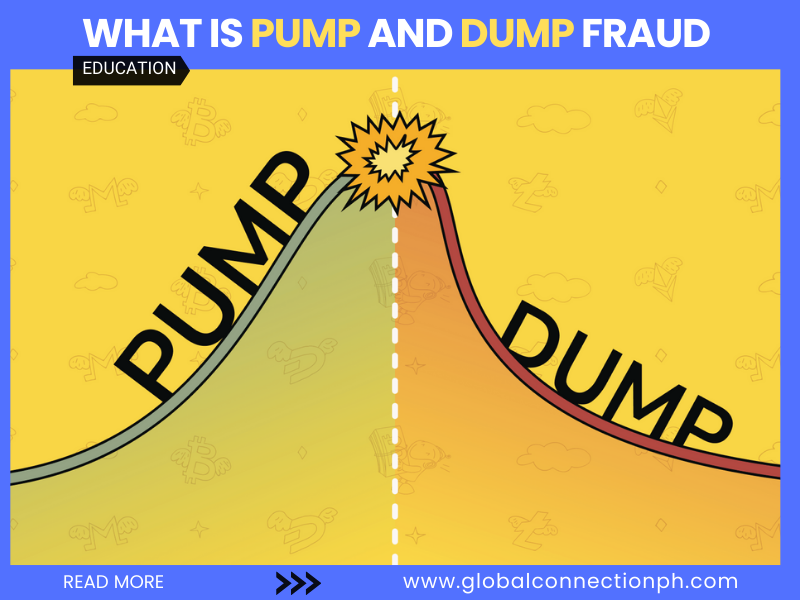

The basic idea behind this scheme is to artificially inflate (or "pump") the price of a cryptocurrency to attract unsuspecting investors. Once the price has risen, the fraudsters sell off (or "dump") their holdings at a profit, leaving other investors with losses as the price falls dramatically.

Which markets are prone to pump and dump?

Pump and dump usually happens in shallow markets. Assets with low market value (market cap, total working capital) are more at risk.

For this reason, one or more fraudsters cannot pump and dump the market of Bitcoin, Ethereum, Cardano and other cryptocurrencies with billions of dollars in circulating capital, and this work is only done by whales and large-scale crypto exchanges.

Overall, markets with low working capital are more prone to pump and dump.

For this reason, fraudsters often go for cryptocurrencies with a low market cap; The smaller the market cap of a cryptocurrency and the volume of buying and selling in it, the more the collection of a large volume of its coins or tokens from the market affects the price.

For example, in the cryptocurrency market, a token with a market cap of less than 1 million dollars is more vulnerable to pump and dump compared to a token with a market cap of more than 20 million dollars.

How Does Pump and Dump Work?

.png)

Here's a step-by-step breakdown of how the pump and dump scheme operates:

Choosing a Target Coin: The fraudsters select a cryptocurrency, often one that is relatively unknown and has low trading volume. This makes it easier to manipulate the price without attracting too much attention.

Creating Hype: The scammers begin to spread false or misleading information about the chosen cryptocurrency.

They might use social media platforms, online forums, or chat rooms to create excitement.

This could include touting the coin as having a ground-breaking technology or claiming that a famous investor is backing it.

The Pump: As more people learn about the coin, they start buying it, which causes its price to rise rapidly.

This often leads to more and more people wanting to jump on the bandwagon, further driving up the price.

Scammers may use tactics such as "FOMO," or "fear of missing out," to encourage more people to invest quickly.

The Dump: Once the price has reached a certain level—usually much higher than its actual value—the fraudsters sell off their holdings.

They make a profit by selling at the inflated price, while the rest of the investors are left holding coins that are now worth much less.

The Aftermath: After the dump, the price of the cryptocurrency crashes, and many investors suffer significant losses.

The fraudsters disappear, often using fake accounts, making it difficult for victims to seek restitution.

Why is Pump and Dump Common in Cryptocurrency?

Pump and dump schemes are particularly prevalent in the cryptocurrency market for several reasons:

Lack of Regulation: Unlike traditional stock markets, the cryptocurrency market is not as heavily regulated. This makes it easier for scammers to operate without fear of legal consequences.

Anonymity: Many cryptocurrencies allow users to remain anonymous, making it challenging to trace fraudulent activities back to the perpetrators.

Passion for Cryptocurrency: The growing excitement around cryptocurrencies encourages many individuals to invest without doing proper research. This eagerness can make people more susceptible to scams.

How to Spot a Pump and Dump Scheme

Detecting a potential pump and dump can be tricky, but there are several red flags to look out for:

Unrealistic Promises: If a cryptocurrency is being promoted with promises of guaranteed returns or rapid price increases, it's a warning sign. Remember, if something seems too good to be true, it probably is.

Lack of Information: If you can't find solid information about a cryptocurrency or its developers, proceed with caution. Legitimate projects will have transparency and good resources.

Sudden Hype: If you notice sudden and extreme hype on social media, especially from accounts with few followers or no history of credibility, be wary.

Rising Prices Without News: Monitor the price movement of cryptocurrencies. If a coin’s price doubles or triples in a matter of days without any significant news or partnerships to justify it, this could be a pump and dump.

Urgency: Be cautious of messages urging immediate action or investment. Scammers often create a sense of urgency to provoke impulsive decisions.

How to Protect Yourself

While it’s difficult to avoid all risks in the cryptocurrency landscape, there are strategies you can adopt to protect yourself from pump and dump scams:

Do Your Research: Before investing in any cryptocurrency, take the time to research it thoroughly. Look into the project’s background, the development team, and its roadmap.

Diversify Your Investments: Avoid putting all your money into one type of cryptocurrency. Having a diversified portfolio can reduce risk.

Stay Informed: Follow reputable sources of cryptocurrency news. This will help you distinguish between legitimate information and hype-driven nonsense.

Avoid Social Media Hype: Be skeptical of investment advice delivered through social media platforms, especially if the source is unknown or unverified.

Use Trusted Exchanges: Always buy and sell cryptocurrencies through well-established and reputable exchanges. These platforms have security measures to protect users.

Understanding Pump and Dump Fraud in the Cryptocurrency Market

Cryptocurrency is a fascinating digital world full of opportunities and challenges. One of the darker sides of this world is a scam known as "pump and dump." In this article, we will break down what pump and dump fraud is, how it works, and how you can protect yourself from falling victim to it.

What is Pump and Dump Fraud?

Pump and dump is an illegal practice in financial markets, not just in cryptocurrency. Recently, with the growth of online platforms and the rise of cryptocurrencies, this scheme has become more common among scammers.

The absence of clear regulations and laws related to cryptocurrency has made it easier for fraudsters to target people with cryptocurrency pump and dump scams.

The basic idea behind this scheme is to artificially inflate (or "pump") the price of a cryptocurrency to attract unsuspecting investors. Once the price has risen, the fraudsters sell off (or "dump") their holdings at a profit, leaving other investors with losses as the price falls dramatically.

Which markets are prone to pump and dump?

Pump and dump usually happens in shallow markets. Assets with low market value (market cap, total working capital) are more at risk.

For this reason, one or more fraudsters cannot pump and dump the market of Bitcoin, Ethereum, Cardano and other cryptocurrencies with billions of dollars in circulating capital, and this work is only done by whales and large-scale crypto exchanges.

Overall, markets with low working capital are more prone to pump and dump. For this reason, fraudsters often go for cryptocurrencies with a low market cap; The smaller the market cap of a cryptocurrency and the volume of buying and selling in it, the more the collection of a large volume of its coins or tokens from the market affects the price.

For example, in the cryptocurrency market, a token with a market cap of less than 1 million dollars is more vulnerable to pump and dump compared to a token with a market cap of more than 20 million dollars.

How Does Pump and Dump Work?

Here's a step-by-step breakdown of how the pump and dump scheme operates:

Choosing a Target Coin: The fraudsters select a cryptocurrency, often one that is relatively unknown and has low trading volume. This makes it easier to manipulate the price without attracting too much attention.

Creating Hype: The scammers begin to spread false or misleading information about the chosen cryptocurrency.

They might use social media platforms, online forums, or chat rooms to create excitement. This could include touting the coin as having a ground-breaking technology or claiming that a famous investor is backing it.

The Pump: As more people learn about the coin, they start buying it, which causes its price to rise rapidly. This often leads to more and more people wanting to jump on the bandwagon, further driving up the price. Scammers may use tactics such as "FOMO," or "fear of missing out," to encourage more people to invest quickly.

The Dump: Once the price has reached a certain level—usually much higher than its actual value—the fraudsters sell off their holdings. They make a profit by selling at the inflated price, while the rest of the investors are left holding coins that are now worth much less.

The Aftermath: After the dump, the price of the cryptocurrency crashes, and many investors suffer significant losses. The fraudsters disappear, often using fake accounts, making it difficult for victims to seek restitution.

Why is Pump and Dump Common in Cryptocurrency?

Pump and dump schemes are particularly prevalent in the cryptocurrency market for several reasons:

Lack of Regulation: Unlike traditional stock markets, the cryptocurrency market is not as heavily regulated. This makes it easier for scammers to operate without fear of legal consequences.

Anonymity: Many cryptocurrencies allow users to remain anonymous, making it challenging to trace fraudulent activities back to the perpetrators.

Passion for Cryptocurrency: The growing excitement around cryptocurrencies encourages many individuals to invest without doing proper research. This eagerness can make people more susceptible to scams.

How to Spot a Pump and Dump Scheme

Detecting a potential pump and dump can be tricky, but there are several red flags to look out for:

Unrealistic Promises: If a cryptocurrency is being promoted with promises of guaranteed returns or rapid price increases, it's a warning sign. Remember, if something seems too good to be true, it probably is.

Lack of Information: If you can't find solid information about a cryptocurrency or its developers, proceed with caution. Legitimate projects will have transparency and good resources.

Sudden Hype: If you notice sudden and extreme hype on social media, especially from accounts with few followers or no history of credibility, be wary.

Rising Prices Without News: Monitor the price movement of cryptocurrencies. If a coin’s price doubles or triples in a matter of days without any significant news or partnerships to justify it, this could be a pump and dump.

Urgency: Be cautious of messages urging immediate action or investment. Scammers often create a sense of urgency to provoke impulsive decisions.

How to Protect Yourself

While it’s difficult to avoid all risks in the cryptocurrency landscape, there are strategies you can adopt to protect yourself from pump and dump scams:

Do Your Research: Before investing in any cryptocurrency, take the time to research it thoroughly. Look into the project’s background, the development team, and its roadmap.

Diversify Your Investments: Avoid putting all your money into one type of cryptocurrency. Having a diversified portfolio can reduce risk.

Stay Informed: Follow reputable sources of cryptocurrency news. This will help you distinguish between legitimate information and hype-driven nonsense.

Avoid Social Media Hype: Be skeptical of investment advice delivered through social media platforms, especially if the source is unknown or unverified.

Use Trusted Exchanges: Always buy and sell cryptocurrencies through well-established and reputable exchanges. These platforms have security measures to protect users.

Conclusion:

Pump and dump fraud poses a serious threat in the cryptocurrency market, leaving unsuspecting investors with heavy losses. By understanding how these schemes operate and recognizing key warning signs, you can safeguard your investments.

Always conduct thorough research, remain skeptical of social media hype, and prioritize using reputable exchanges.

As cryptocurrency continues to evolve, staying informed and vigilant is essential for protecting your financial future. Take control of your investments today and make informed decisions to navigate this complex market.

Leave a Reply

Your email address will not be published.